Have you ever wondered why some people struggle to get life insurance while others breeze through the process? Enter Open Care life insurance—a modern approach to life coverage that’s changing the game for millions of Americans. In this comprehensive guide, we’ll explore everything you need to know about this flexible insurance option that’s making waves in the industry.

What is Open Care Life Insurance?

Open Care life insurance represents a revolutionary approach to life coverage that prioritizes accessibility and transparency. Unlike traditional life insurance policies that might come with strict requirements and complicated terms, Open Care simplifies the process while providing comprehensive coverage options for diverse needs.

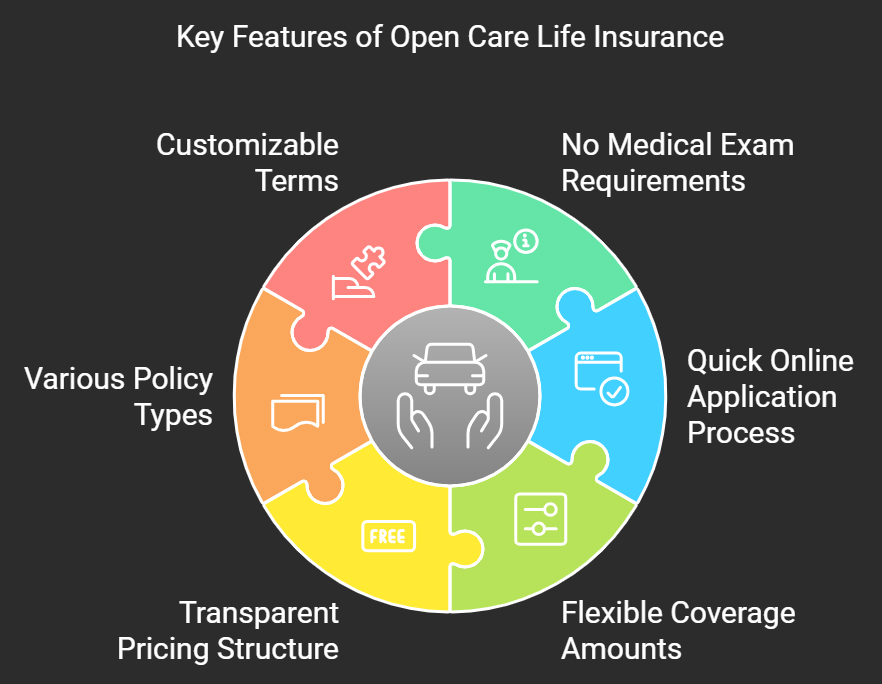

Key Features of Open Care Life Insurance

- No medical exam requirements for many applicants

- Quick online application process

- Flexible coverage amounts

- Transparent pricing structure

- Various policy types under one platform

- Customizable terms to fit individual needs

How Open Care Life Insurance Works

The Application Process

Getting coverage through Open Care is refreshingly straightforward. The platform connects you with multiple insurance providers, allowing you to compare rates and find the best fit for your needs. Here’s what the process typically looks like:

- Complete an online questionnaire

- Receive instant quotes from various providers

- Choose your preferred coverage option

- Submit necessary documentation

- Get approved (often within minutes)

Coverage Options Available

Open Care offers several types of life insurance policies to meet different needs:

- Term Life Insurance: Coverage for a specific period (10, 20, or 30 years)

- Whole Life Insurance: Lifetime coverage with cash value accumulation

- Universal Life Insurance: Flexible premium payments and death benefits

- Final Expense Insurance: Smaller policies designed to cover end-of-life expenses

Benefits of Choosing Open Care Life Insurance

Accessibility and Convenience

One of the most significant advantages of Open Care life insurance is its accessibility. The platform has revolutionized the traditional insurance buying process by:

- Offering 24/7 online access to information and applications

- Providing instant quotes without lengthy waiting periods

- Eliminating the need for in-person meetings

- Supporting digital document submission

Competitive Pricing

Statistics show that Open Care users save an average of 30% compared to traditional insurance channels. This cost-effectiveness stems from:

- Direct-to-consumer model reducing overhead costs

- Competition among multiple insurers

- Automated underwriting processes

- Lower administrative expenses

Understanding the Cost Factors

Several elements influence your Open Care life insurance premiums:

Primary Cost Determinants

- Age

- Health status

- Coverage amount

- Policy type

- Term length (for term policies)

- Lifestyle factors

- Occupation

Ways to Optimize Your Premium

Want to secure the best possible rates? Consider these strategies:

- Apply while you’re young and healthy

- Maintain a healthy lifestyle

- Choose an appropriate coverage amount

- Compare multiple providers

- Consider longer-term policies for better rates

Who Should Consider Open Care Life Insurance?

Open Care life insurance is particularly suitable for:

Ideal Candidates

- Young families seeking affordable coverage

- Individuals with pre-existing conditions who struggle with traditional insurance

- People who prefer a digital-first experience

- Those looking for quick approval

- Budget-conscious insurance shoppers

Common Questions About Open Care Life Insurance

Is Open Care Life Insurance Legitimate?

Yes, Open Care partners with established, A-rated insurance providers. The platform is licensed and regulated in all 50 states, providing secure and reliable coverage options.

How Does It Compare to Traditional Insurance?

Traditional Insurance vs. Open Care:

- Application Process: Weeks vs. Minutes

- Medical Exam: Usually Required vs. Often Waived

- Price Comparison: Limited vs. Multiple Quotes

- Customer Service: Business Hours vs. 24/7 Access

Tips for Choosing the Right Open Care Policy

Essential Considerations

Before selecting a policy, evaluate:

- Your Coverage Needs: Calculate your financial obligations and future expenses

- Budget Constraints: Determine what premium payments you can comfortably afford

- Policy Duration: Decide between term and permanent coverage

- Additional Riders: Consider extra features that might benefit your situation

- Provider Ratings: Research the financial strength of insurance carriers

Making the Most of Your Open Care Life Insurance

Policy Management Tips

To maximize your coverage benefits:

- Review your policy annually

- Update beneficiary information as needed

- Take advantage of digital tools and resources

- Stay informed about policy changes and updates

- Consider increasing coverage during life changes

The Future of Open Care Life Insurance

The insurance industry continues to evolve, and Open Care is at the forefront of innovation. Recent trends indicate:

- Increased integration of artificial intelligence in underwriting

- Enhanced mobile accessibility

- Expanded coverage options

- More personalized policy recommendations

- Improved claim processing systems

Conclusion: Is Open Care Life Insurance Right for You?

Open Care life insurance represents a significant shift in how we think about and purchase life insurance. Its combination of accessibility, competitive pricing, and flexible options makes it an attractive choice for many Americans seeking financial protection for their loved ones.

Ready to explore your options? Consider taking these next steps:

- Assess your coverage needs using Open Care’s online calculator

- Request quotes from multiple providers

- Compare policy features and benefits

- Consult with an Open Care representative for personalized guidance

Remember, the best insurance policy is the one that provides adequate coverage for your specific situation while fitting comfortably within your budget. Open Care’s platform makes finding that perfect match easier than ever before.