Long-term care insurance is a critical component of financial planning, especially as people age and face the potential need for extended care services. One provider that stands out in the industry is Thrivent, a not-for-profit membership-based organization that offers a variety of financial services and insurance products. In this article, we will provide a comprehensive review of Thrivent Long-Term Care Insurance, examining the key features, benefits, customer experiences, and how it compares to other options in the market.

What is Thrivent Long-Term Care Insurance?

Long-term care insurance helps cover the cost of services needed to support people who can no longer perform basic activities of daily living (ADLs), such as bathing, dressing, eating, and moving around. These services are typically not covered by traditional health insurance or Medicare, which can leave individuals facing significant out-of-pocket expenses.

Thrivent Long-Term Care Insurance is designed to offer financial protection for these services, whether care is provided in a nursing home, an assisted living facility, or in the policyholder’s home. As a part of its holistic financial planning services, Thrivent’s policies aim to protect its members from the high costs associated with extended care and provide peace of mind for both individuals and their families.

Why is Long-Term Care Insurance Important?

As life expectancy increases, more people are facing the reality of needing long-term care at some point in their lives. According to the U.S. Department of Health and Human Services, nearly 70% of people turning 65 today will need long-term care at some point. Without insurance, long-term care costs can be overwhelming. The average annual cost of a private room in a nursing home in 2023 was about $108,405, while the cost of a home health aide averaged $64,800 per year.

This is where Thrivent Long-Term Care Insurance comes into play. It provides a way to mitigate these financial risks by offering policies tailored to individual needs, helping families avoid depleting their savings to cover extended care costs.

Key Features of Thrivent Long-Term Care Insurance

Thrivent’s long-term care insurance offers various features that make it a viable choice for individuals seeking comprehensive coverage. Here are some key aspects of their policies:

1. Comprehensive Coverage

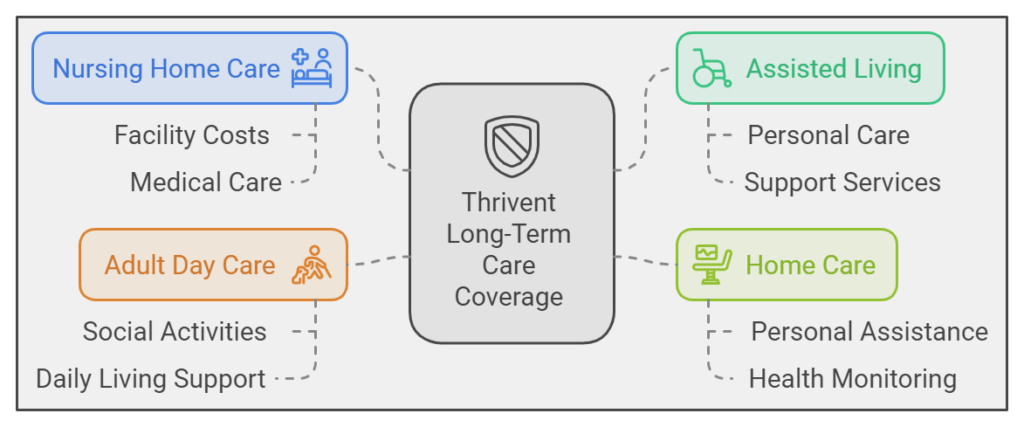

Thrivent offers long-term care policies that cover a range of services, including:

- Nursing Home Care: Covers the cost of care in a licensed nursing home facility.

- Assisted Living: Offers coverage for services provided in assisted living facilities.

- Home Care: Thrivent covers in-home care services, enabling policyholders to receive care in the comfort of their homes.

- Adult Day Care: Policies may also cover adult day care centers that provide daytime assistance.

2. Flexibility in Coverage Options

Thorvent understands that every individual’s needs are unique. Policyholders can choose the level of coverage that fits their specific situation. Options include:

- Daily Benefit Amount: The maximum daily amount that the policy will pay for long-term care services.

- Benefit Period: Policyholders can select the duration for which they want coverage, ranging from two years to a lifetime.

- Elimination Period: Thrivent allows individuals to choose the waiting period (typically 30 to 90 days) before benefits begin.

3. Inflation Protection

One of the most important features of long-term care insurance is inflation protection. Thrivent offers options that allow your benefits to increase over time, helping your coverage keep pace with the rising costs of care. This is particularly critical given that the cost of care tends to rise faster than inflation in many regions.

4. Customizable Riders

Thrivent offers several riders that policyholders can add to their base plan to enhance coverage:

- Shared Care Rider: This allows couples to share benefits, ensuring that if one spouse uses up their benefits, the other can tap into the shared pool.

- Return of Premium Rider: This rider ensures that if the policyholder doesn’t use their long-term care benefits, a portion of the premiums is returned to their estate.

- Waiver of Premium Rider: Thrivent’s policies often include this rider, which waives premium payments while receiving care.

5. Thrivent’s Nonprofit Status

Thrivent is unique in that it operates as a nonprofit membership organization. Policyholders are members and part-owners of the organization, allowing Thrivent to return profits back to its members and the community through benefits like dividends and charitable outreach.

Pros of Thrivent Long-Term Care Insurance

There are several advantages to choosing Thrivent for your long-term care insurance needs:

1. Financial Stability

Thrivent has been providing financial services for over a century. It is rated highly by independent agencies for its financial strength and claims-paying ability, which is crucial when you are buying insurance intended for future use.

2. Flexible Plan Options

Thrivent offers a wide array of policy options and riders, allowing individuals to tailor their plan to their specific needs. This level of customization is not available with all long-term care insurers.

3. Member Benefits

Since Thrivent is a membership organization, policyholders benefit from services beyond just insurance, such as financial advice, discounts, and the opportunity to participate in Thrivent’s community impact programs.

4. Focus on Faith-Based Values

Thrivent’s roots are in the Christian faith, and the organization emphasizes values such as stewardship and community impact. For those who align with this worldview, Trinity’s mission-driven approach may resonate.

Cons of Thrivent Long-Term Care Insurance

Despite its strengths, there are some potential downsides to consider when evaluating Thrivent Long-Term Care Insurance:

1. Cost

While Thrivent offers a range of flexible options, long-term care insurance in general can be expensive. Premiums depend on factors such as age, health, and coverage level and may increase over time.

2. Limited Availability

Thrivent’s long-term care insurance products are only available to members of the organization. While Triumph has millions of members nationwide, this limitation means that not everyone will qualify to purchase a policy.

3. Health Underwriting

Like most long-term care insurers, Thrivent requires medical underwriting for its policies. Individuals with pre-existing health conditions may find it more difficult to qualify for coverage, or they may face higher premiums.

How Thrivent Long-Term Care Insurance Compares to Other Providers

When considering long-term care insurance, it’s helpful to compare Thrivent with other leading providers, such as Genworth, Mutual of Omaha, and New York Life. Below is a brief comparison:

| Provider | Financial Strength | Coverage Options | Notable Features | Eligibility |

|---|---|---|---|---|

| Thrivent | A++ (Superior) | Highly flexible | Faith-based values, member benefits, shared care rider | Members only |

| Genworth | B++ (Good) | Flexible | Extensive experience in LTC market | Open to all |

| Mutual of Omaha | A+ (Superior) | Standard & Custom | Competitive premiums, spousal discounts | Open to all |

| New York Life | A++ (Superior) | High-end | Comprehensive plans, lifetime benefits | Open to all |

Thrivent stands out for its nonprofit structure and focus on member benefits, while other providers may offer slightly more flexibility in terms of eligibility.

Customer Reviews and Testimonials

Understanding customer experiences can provide deeper insight into what it’s like to own a Thrivent Long-Term Care Insurance policy. Based on online reviews and testimonials, here are some common themes:

Positive Feedback

- Customer Service: Many Thrivent customers praise the organization’s excellent customer service, noting that agents are knowledgeable, patient, and helpful when explaining complex policies.

- Claims Process: Several policyholders report a smooth claims process, which is a key consideration when choosing long-term care insurance.

- Community Focus: Thrivent’s commitment to social impact and charitable giving resonates with many customers, who appreciate being part of an organization that gives back.

Negative Feedback

- Premium Increases: Like many long-term care insurers, some Thrivent policyholders have expressed concerns about rising premiums, especially as they age.

- Eligibility Restrictions: Potential customers who aren’t already affiliated with Thrivent’s membership base may feel excluded from purchasing policies.

Is Thrivent Long-Term Care Insurance Right for You?

Choosing the right long-term care insurance is a personal decision that depends on several factors, including your age, health, financial situation, and preferences for care. Here are some questions to consider before choosing Thrivent:

- Do you want to be part of a nonprofit, membership-based organization with a Christian focus?

- Are you looking for flexible options that can be tailored to your needs?

- Is financial stability and the ability to pay claims a high priority for you?

- Do you have a spouse with whom you’d like to share long-term care benefits?

If you answered yes to these questions, Thrivent Long-Term Care Insurance may be an excellent option for you. However, it’s essential to compare the costs and benefits against other providers to ensure it aligns with your financial goals.

Conclusion

In summary, Thrivent Long-Term Care Insurance offers a robust range of options designed to meet the needs of individuals seeking comprehensive coverage for extended care services. With its financial stability, customizable plans, and mission-driven focus, Thrivent is a strong contender in the long-term care insurance market. However, it’s essential to weigh the cost and availability factors before committing to a policy. For those who align with Thrivent’s values and membership structure, it could provide both peace of mind and financial security for the future.

If you’re considering long-term care insurance, reach out to

a Thrivent financial advisor for a personalized consultation and explore whether their offerings fit your needs. Taking steps now can help protect your assets and ensure you and your loved ones receive the care you need later in life.